Insurance companies have quietly shifted how they price some of the most common tow rigs on the road. New loss data and fresh signals from regulators show certain pickups getting singled out right now – and one of the most popular trucks isn’t on that list.

If you pull a travel trailer or fifth wheel, this could change what you pay and how easy it is to get full coverage.

How We Built This List

We focused on pickups commonly used to tow travel trailers and fifth wheels, because that’s where insurance costs hit RV owners hardest. Tow ratings, payload, and configuration matter, so we looked at late-model trucks typically popular for towing. We did not include vans, chassis cabs, or exotic specialty builds.

To understand risk, we pulled from three public signals that mirror insurer behavior:

- HLDI theft-loss data: shows how often specific truck configurations are stolen and how severe those claims are.

- New York’s “Difficult-to-Insure Vehicles” list: reveals models many carriers avoid or limit in that state, a rare public view of underwriting appetite.

- NICB theft reports: show which vehicles lead in raw theft counts nationwide, adding context to why some trucks get more expensive to insure.

This approach doesn’t unlock each carrier’s proprietary math, but it’s the clearest way to see where risk is trending for tow-capable pickups right now.

Disclaimer

Insurance risk ratings are not universal or permanent. Every carrier uses its own pricing algorithms and underwriting guidelines, which can change by state, driver profile, and over time. No one outside the companies sees the exact formulas. This article uses the best public signals available – HLDI theft-loss data, New York’s “Difficult-to-Insure Vehicles” list, and NICB theft reports – to show where insurers are currently treating some trucks as higher risk. These sources don’t replace each carrier’s proprietary models, but they’re the clearest publicly available indicators of where insurers see elevated risk right now.

Trucks Now Flagged as Higher Risk

Based on the latest Highway Loss Data Institute (HLDI) theft-loss report and confirmation from New York’s Difficult-to-Insure Vehicles list, these are the pickups drawing the most insurer caution right now. They’re the models RV owners are most likely to see higher comprehensive premiums on, and in some markets carriers may limit or tighten physical-damage coverage.

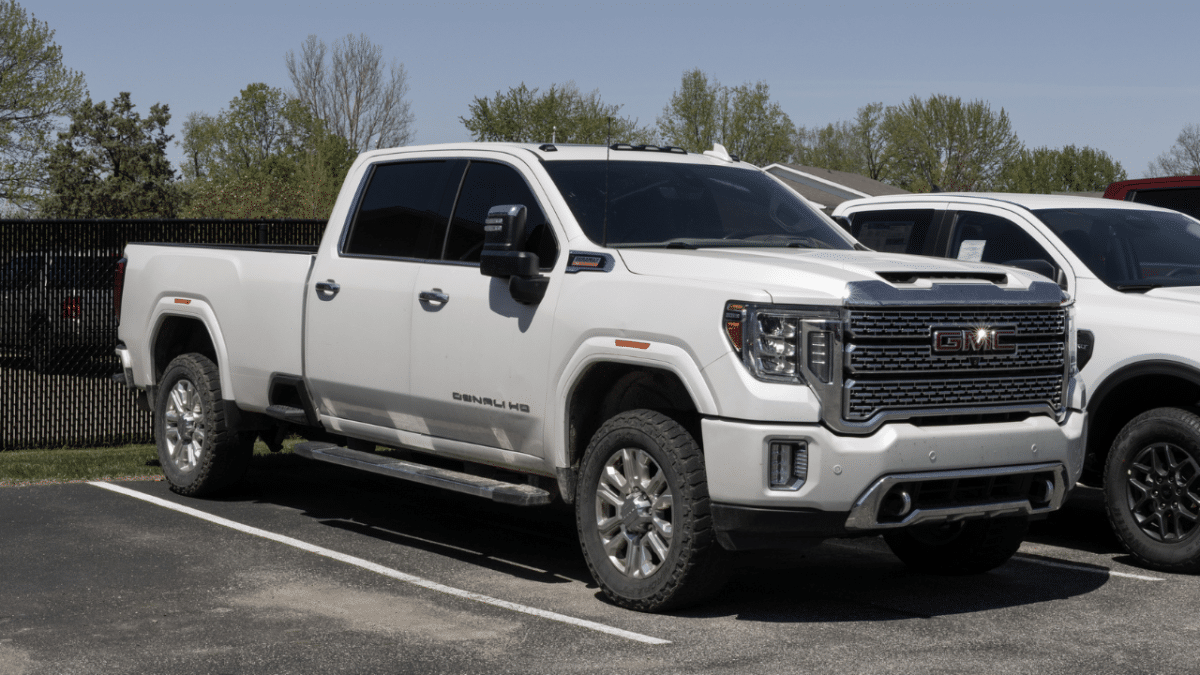

1. GMC Sierra 2500 & 3500 Crew Cab 4WD

HLDI shows these heavy-duty Sierras near the top for theft claims. They’re a favorite for hauling big travel trailers and fifth wheels, and their high price and expensive parts make each theft costly for insurers.

2. Chevrolet Silverado 2500 & 3500 Crew Cab 4WD

These Silverado HD models also rank high for theft losses. They’re widely used for larger trailers, and their popularity, repair costs, and resale value push insurance risk higher.

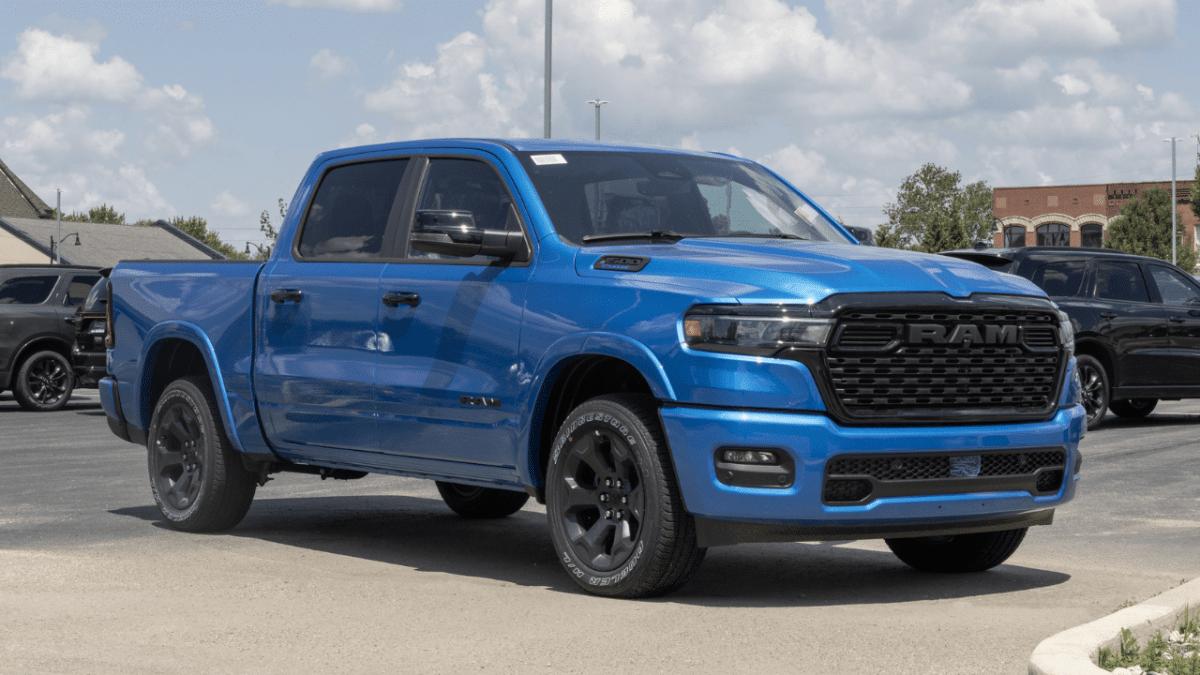

3. Ram 1500 Crew Cab Short-Wheelbase 4WD

Among light-duty pickups, the Ram 1500 crew cab 4WD stands out for higher theft-claim rates. It’s a popular choice for towing mid-size travel trailers, and its high market value and costly parts make it more expensive for insurers to cover.

4. Ram 3500 Crew Cab Long-Wheelbase 4WD

The Ram 3500 shows elevated theft-loss numbers, too. Its heavy-duty build and high replacement cost drive up claim payouts when it’s stolen.

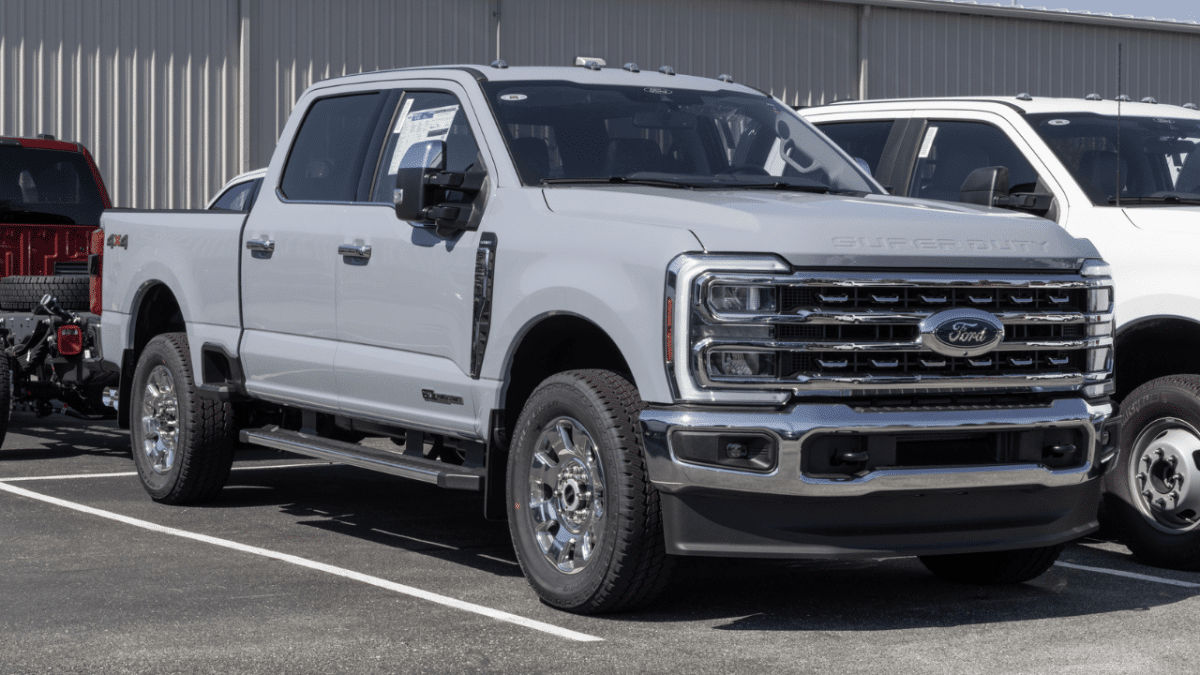

5. Ford Super Duty (F-250, F-350, F-450)

While not topping HLDI’s theft rankings, New York’s insurance regulator lists these trucks as difficult to insure because many carriers restrict or surcharge them. That signals real underwriting caution, especially for RV tow setups.

Why these trucks stand out:

- Pickups as a group lead all vehicle types for theft frequency and average loss in the latest HLDI dataset.

- Heavy-duty builds mean higher replacement and repair bills.

- High popularity keeps them on thieves’ radar and increases claim volume.

Now, I know what you’re probably thinking – what truck isn’t considered “high risk” to insure?

What Trucks Aren’t on the List

Not every tow-capable pickup is drawing extra scrutiny right now. A few widely used models do not appear in the latest HLDI high-theft tables and aren’t on New York’s difficult-to-insure list for trucks. That doesn’t mean they’re cheap to insure everywhere, but it shows they’re not singled out the way the heavy-duty models above are.

Also, I should note, these aren’t necessarily the highest-capacity trucks on the market. Most can handle small to medium travel trailers, but owners of large fifth wheels or heavy toy haulers may still need to look at heavier-duty options, which, unfortunately, are the ones showing up on insurers’ watch lists.

Ford F-150

Still one of the most popular tow rigs in America, but it’s not on the exposure-adjusted theft-loss list for 2022–2024. Some trims can be expensive if loaded with luxury features, yet insurers haven’t flagged the F-150 as unusually theft-prone overall.

Chevrolet Silverado 1500

Also absent from HLDI’s top theft-frequency rankings. It can show up on NICB’s raw “most stolen” lists because there are so many on the road, but its theft rate per insured vehicle isn’t elevated in the current HLDI data.

Toyota Tundra

Known for reliability and towing strength. Not in HLDI’s high-theft group and not on New York’s restricted list. Premiums still vary, but it doesn’t show up as a special underwriting concern.

Nissan Titan

Likewise, absent from the high-theft data and from the NY regulator’s list. Not a major focus of insurer risk models right now.

Ram 2500

Surprisingly, the Ram 2500 doesn’t appear in HLDI’s high-theft rankings, even though its 1500 and 3500 counterparts do. Insurers can still price it higher in some markets, but it’s not flagged as an outlier in the current public data.

These trucks prove the list isn’t “every pickup.” Many popular half-tons and some three-quarter-tons haven’t triggered the theft-loss spikes or underwriting reluctance that put the others on watch.

What This List Really Means for RV Owners

Being on a “high risk” list doesn’t mean you can’t insure the truck or that every carrier will price it the same. It means the public data show higher theft claims and costlier repairs, and some insurers respond with higher premiums, stricter deductibles, or limits on physical-damage coverage.

Rates also change by state and personal profile. A truck flagged in one market may still get competitive quotes from another carrier nearby. Companies weigh theft, repair cost, and driver history differently.

If you’re shopping or planning to upgrade your tow vehicle, these signals give you an early warning. They show which trucks might trigger extra questions or higher bills when you ask for a quote.

How to Keep Insurance Costs Manageable

Even if your truck shows up on a high-risk list, there are ways to reduce what you pay and avoid surprises when towing.

- Shop more than one carrier. Each company prices risk differently, and some are more comfortable with heavy-duty pickups than others.

- Document anti-theft gear. Factory alarms, immobilizers, GPS trackers, and aftermarket security devices may help with rates with certain carriers.

- Consider higher deductibles. Raising your comp or collision deductible can lower premiums, but only if you’re prepared for the larger out-of-pocket cost after a loss.

- Ask about towing endorsements. If you pull a travel trailer or fifth wheel, make sure your policy reflects the correct hitch class and trailer brakes; it can prevent denied claims later.

- Take towing safety or defensive driving courses. Some carriers give small credits as it shows responsible use of a higher-risk vehicle.

These steps won’t erase the higher theft exposure for certain trucks, but they can keep premiums from climbing further.

Key Takeaway

Insurance companies don’t publish their formulas, and risk ratings change with new data, model updates, and theft trends. Still, HLDI theft-loss reports, New York’s “Difficult-to-Insure Vehicles” list, and NICB theft counts give a reliable picture of which tow-capable pickups are drawing the most attention right now.

For RV owners, the message is straightforward: if you’re shopping for a heavy-duty GMC Sierra, Chevrolet Silverado HD, Ram 1500 or 3500, or Ford Super Duty, expect more underwriting scrutiny and potentially higher comprehensive premiums. If you’re running a half-ton like the F-150, Silverado 1500, Tundra, Titan, or Ram 2500, you’re not on the watch lists at this time, though rates can still vary widely by carrier and location.

Knowing where your truck stands lets you compare quotes with clearer expectations and avoid surprises before you hook up and head out.

Write a comment